IMPORTANT NOTICE

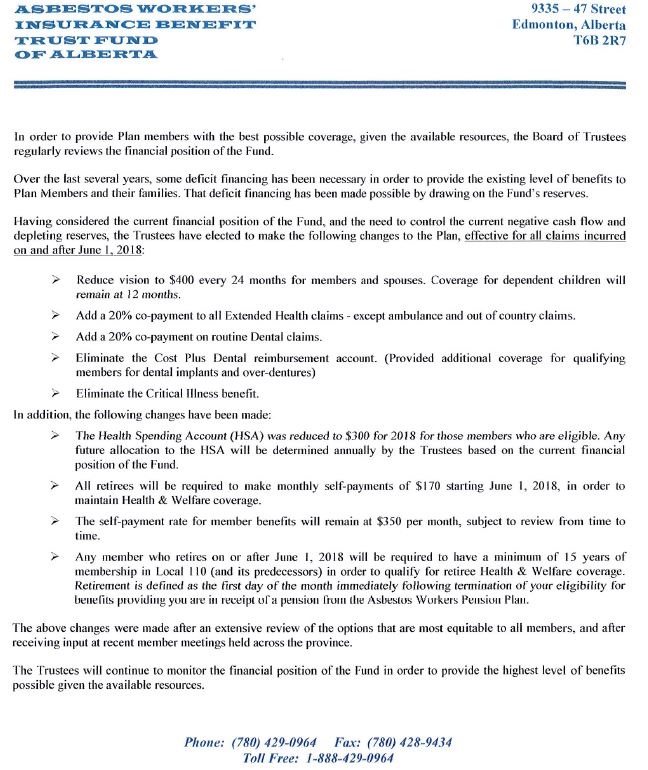

Please see the attached letter from our H&W Trustees regarding changes to the Plan. Changes are in effect for all claims incurred on and after June 1, 2018

Beneficiary Designations

Sometimes it seems like it would be easier to have ONE beneficiary card/form that would apply to ALL THREE plans at the Hall. So why don’t we do that?

Each plan runs independent of each other and the law requires us to make sure you know who you are naming as beneficiary for each plan. If we don’t meet the terms of the law, your beneficiary could be denied the benefits you wanted them to have. That’s why you must fill out a separate card/form for each of:

Local 110 Mortuary Plan

Asbestos Workers Insurance Benefit Trust Fund of Alberta

Asbestos Workers Pension Plan of Alberta

It is also important to review your beneficiaries with each plan after major life events such as: start or end of a relationship or death of a loved one.

In addition to beneficiary designations, it is important to keep the dependent information that is filed with the fund office up to date. When life events such as: marriage; start or end of a relationship, birth of a child, etc., occur it is very important that you contact the fund office so an enrollment form can be forwarded to you for completion. If your dependent information is not current and you submit a claim form to the Insurance Company, they will deny the claim for anyone where information is not on file.